2 February 2023

INTRODUCTION

Amid market uncertainty and new financial regulations, banks must focus on customer profitability to maintain a competitive edge. Three key strategies include discontinuing unprofitable relationships, transforming potential ones, and maximizing profits from existing customers. i4-Profit, a CRM software, helps banks forecast profitability, offering a mix of products to ensure every customer relationship is profitable. This proactive approach will be crucial for banks to thrive in the evolving economic landscape.

ABOUT i4 Profit

i4-Profit supports products on both the asset-side as well as liability-side of any portfolio.

Asset-side includes credit products (personal loan, mortgage loan, overdraft, working-capital loan, credit line, investment loan, car loan, leasing, credit card). Additionally, this includes trade finance (guarantee, letter of credit, factoring).

Liability-side includes deposits (incl. savings account, demand deposit, term deposit); Transactions (incl. transfer, direct debit, e-banking); Insurance (stand-alone, bundled); Treasury (incl. FX spot, FX forward, treasury limit); Investments.

Making every relationship profitable – i4-Profit has four key principal areas of focus:

- Achieve increased profitability from customer relationships. Earning greater profitability from customer relationship portfolios requires better allocation of equity with optimized profitability of the products being sold. i4-Profit enables sales and relationship managers to define customer relationship profitability for the bank prior to signing agreements and deciding whether prognosis of profitability will fit within their KPIs and goals.

- Make every transaction profitable. By making every transaction profitable, users of i4-Profit will not only positively contribute to the bank’s overall bottom line and ROE but will also achieve greater effectiveness of their sales efforts hence, fulfilling KPIs such as ROE, margin on transaction, margin on relationship and portfolio profitability.

- Increase the bottom line. Through a simple interface supported by a sophisticated model configured for each and every customer strategy, i4-Profit strengthens the bank’s ability to convert unprofitable relationships into profitable ones and attracts clients that have a positive impact on the bottom line.

- Increase ROE. By using i4-Profit, banks are avoiding pitfalls caused by changing regulation (MIFID, Basel III). They are choosing the right clients and building profitable relationships. Informed decisions in terms of margins, products, equity and risk through extensive usage of i4-Profit will convert sales people and RMs into first level decision makers helping banks meet profit goals.

i4-Profit advantages come from driving profit maximization in parallel with the best capital allocation. These are achieved by:

- Promoting low capital-intensive products (eg. mortgages vs. leasing vs. plain-vanilla loan)

- Maximization of the total relationship-based profit (always selling a mix of the products)

- Protecting profitability by strict monitoring of the Relationship Officer’s obligations against business as usual

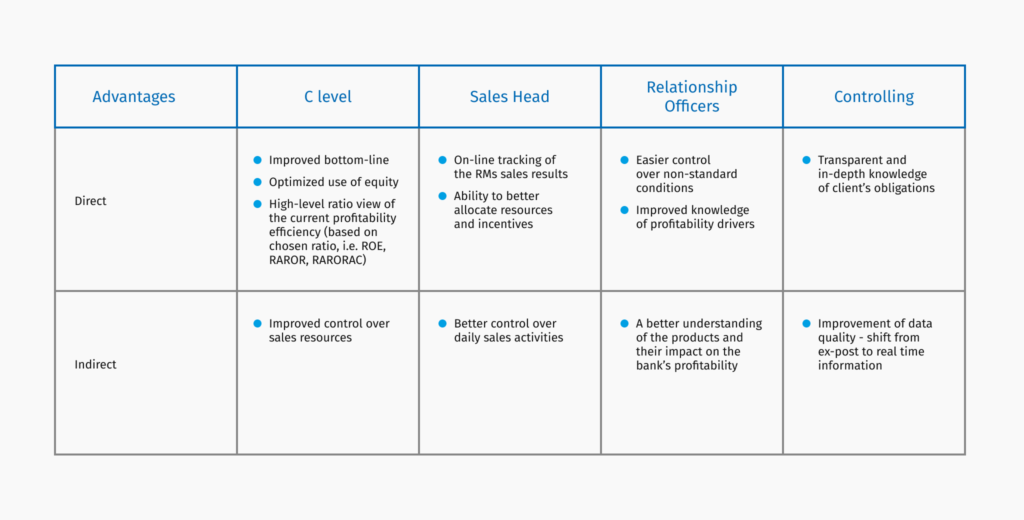

i4-Profit supports users at different levels across all internal stakeholder groups with different information resulting in a user friendly tool making it easier to achieve KPIs. Use of i4-Profit helps bank’s employees to understand how their everyday decisions impact the bottom line of the organization.

The heart of the i4-Profit idea is that the system has influence on all of the abovementioned areas impacting the profit without any changes to the business and operating model of the organization. All what changes is the addition of short i4-Profit-based analysis at the initial stage of selling process. Therefore it does not matter how efficient the organization is, how the motivation system is constructed, what level of skills sales network has etc. for the i4-Profit to work. It means that the system is designed to boost profitability of any financial institution no matter the circumstances.

MARKET TRENDS

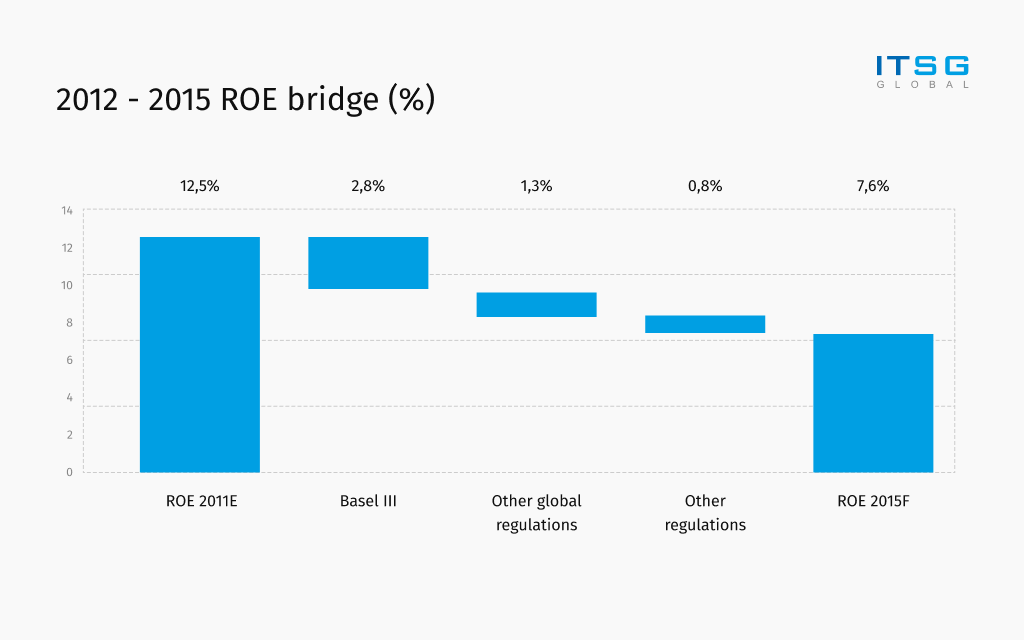

Financial institutions are facing increased pressure on ROE due to the changing regulatory environment and market developments. These include global regulations as well as country specific rules.

Global and regional regulations

Basel III is the regulatory framework issued by the BCBS and builds on earlier frameworks (BASEL II and II.5). The new regulations are due to come into effect on January 1, 2013. The rules are scheduled to be fully phased in by 2021. The main requirements concern capital quality rules, new capital adequacy ratios, leverage ratio, liquidity coverage requirement and net-stable funding ratios.

G-SIFI rules affect all global systemically important financial institutions. The rules are related to capital surcharges for G-SIFIs that are to be introduced in major markets all over the world.

The Directive on Credit Agreements Relating to Residential Property was issued in March 2011 in order to harmonize mortgage lending within the EU and foster mortgage lending. It encompasses a set of standardization rules for mortgage market information disclosures, APR calculations and early repayment rights.

The updated Markets in Financial Instruments Directive (MiFID II) is the revised version of MiFID that was released in October 2011. The regulation strengthens investor protection with advisory services including transparency rules, limitations to inducements from independent advisers and telephone orders for complex financial products

Single Euro Payments Area (SEPA) regulation, issued in March 2012, is a set of new rules designed to simplify and standardize how cross-border payments are processed in the EU. SEPA transcends monetary policy and payment services. It imposes deadlines for implementation of SEPA direct debit, SEPA credit transfer, and requirements on the usage of certain data exchange standards.

Selected country-specific regulations

These specific regulations include the regulations by UK based Independent Commission on Banking. Additionally, Recovery and Resolution Plans (RRPs) as well as fee-based financial advisory requirements in a number of European countries will significantly change how banking business is done. Other country specific regulations include levy and taxes regulations in Germany, law on banking transparency in Italy, FSA’s payment protection products directive together with ICB’s “ring-fencing” recommendations

in the UK and regulation on financial intermediaries in France. Banking operations will be impacted with

an upward pressure on capital requirements and admin costs. While profitability and loan-to-deposit ratios (i.e. funding) will face downward pressures. Key mitigation actions that banks can respond with

include shifting to capital-light operating models, focusing on technology to improve efficiency, employing more advanced pricing techniques and business model alignment.

Banks are losing momentum in their struggle for profitable targets

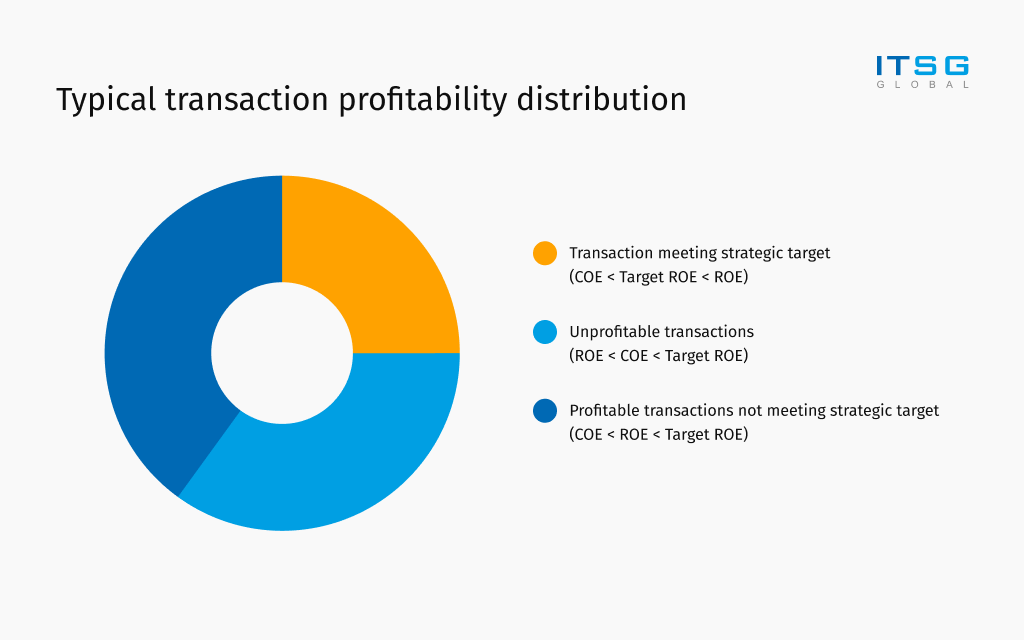

There are several reasons why unprofitable transactions find their way onto balance sheets. There’s a lack of ex-ante knowledge about breakeven points during the time of transaction forcing banks to focus on ex-post profitability reporting and analysis. Banks struggle with insufficient awareness and competence within their sales networks. They feel stuck with outdated sales management systems and sales tools that don’t fully support their personnel throughout the customer life cycle. Finally, incorrectly calibrated motivating systems that don’t drive profitable sales, sticky prices due to time-consuming pricing processes and a lack of standardized ex-post controls of obligations across the sales network (segments, regions, branches, RMs, etc.) make it difficult to weed out unprofitable transactions.

Unprofitable relationships drive profits down in a number of dimensions, i.e. by creating

additional costs stemming from dealing with value destroying client relationships, lack

of awareness which relationships are profitable, inadequate allocation of time and effort

and inability to turn unprofitable customers into profitable ones.

HOW DOES i4-Profit WORK?

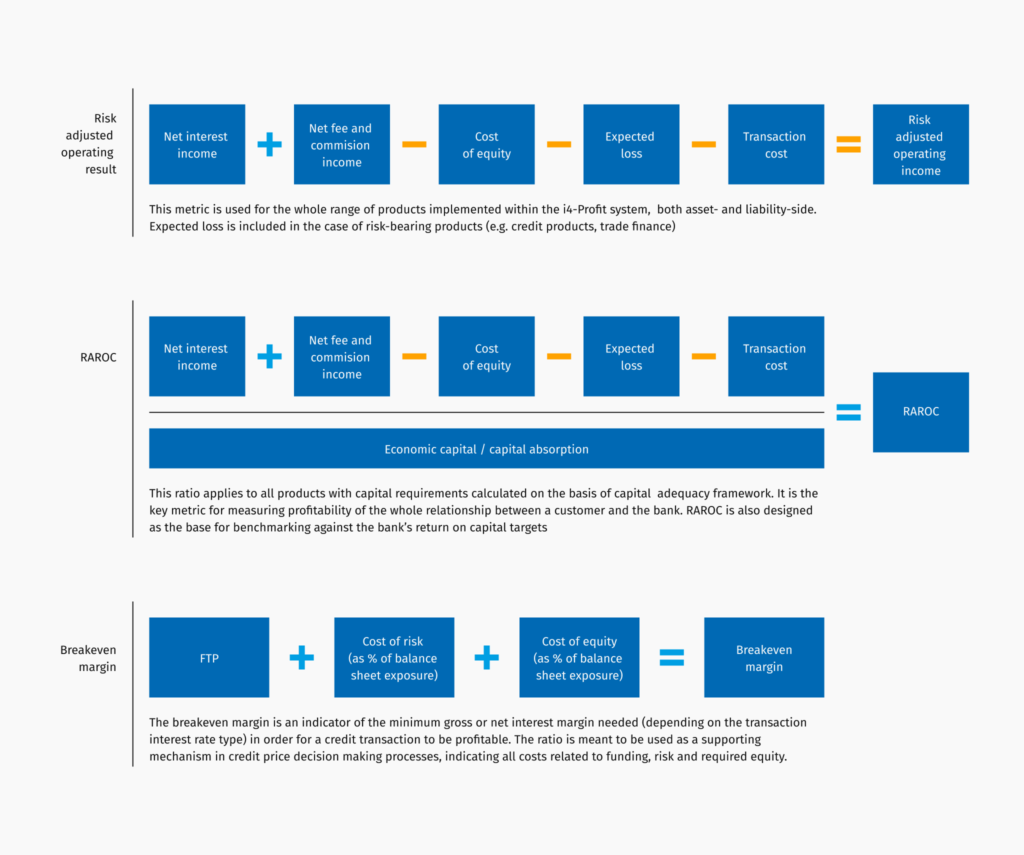

i4-profit methodology is based on profitability metrics widely known and used by the financial industry. The metrics have been carefully selected and customised in order to reflect the true profitability of transactions.

A key factor in the metric’s selection process is its overarching purpose, to help make informed price decisions before transactions are made. This is possible because of the metrics various components that carry out the necessary calculations:

- Net interest income: calculated on the basis of the proposed transaction interest rate (either fixed or floating) and the funds transfer rate that reflects maturity and currency of the transaction

- Net fee and commission income: based on all declared fees and commissions specific for a given transaction and customer tariff

- Cost of equity: based on a BASEL II capital requirement for transactions and required rate of return for the bank

- Expected loss: reflecting probability of default (PD) for a given customer and exposure type, collateral (together with its recovery rates), discount rates adjusted for the time required

for seizure and loss given default (LGD) for the transaction

- Transaction cost: including all the cost born in order to process the transaction both

internally (e.g. personnel costs) and externally (e.g. ACH transaction fees)

- Economic capital/ capital absorption: calculation methodology is compliant with BASEL II capital adequacy framework and ready for the implementation of BASEL III requirements. Our standard capital absorption measure mainly accounts for statutory capital requirements. However, it can be adjusted for the most significant components of financial risk types, i.e. credit risk, market risk, liquidity risk and operational risk

- Funds transfer price (FTP): current (on the day of transaction) cost of funds within the bank for given maturity and currency

- Cost of risk (as % of balance sheet exposure): derived from loss due to default divided by balance sheet exposure

The i4-Profit system includes all initial inputs and assumptions required to efficiently use the system from the start. However, the inputs are subject to revision and parameterization by the client.

The key metrics and methodology

i4-Profit uses robust and market tested metrics for all products including best practice methodology to tailor the software for the unique needs banks anywhere in the world.

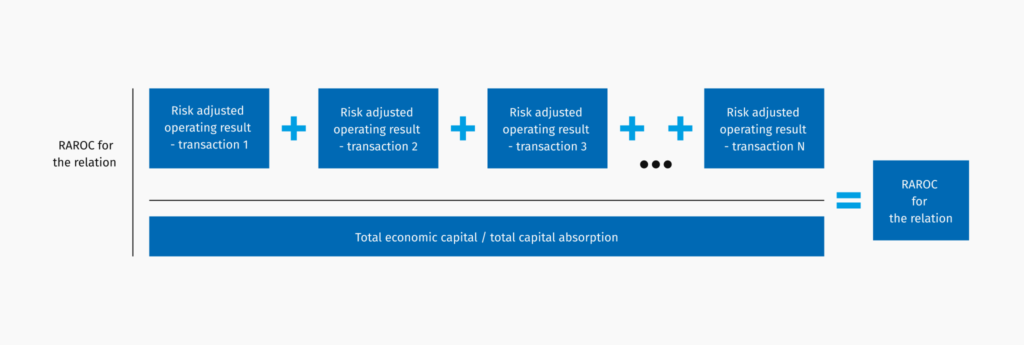

Profitability of the customer relationship is calculated according to the following formula

FOR WHOM?

If you recognize a need to better control your customer profitability distribution at different levels of the organization i4-Profit is for you.

CASE STUDY

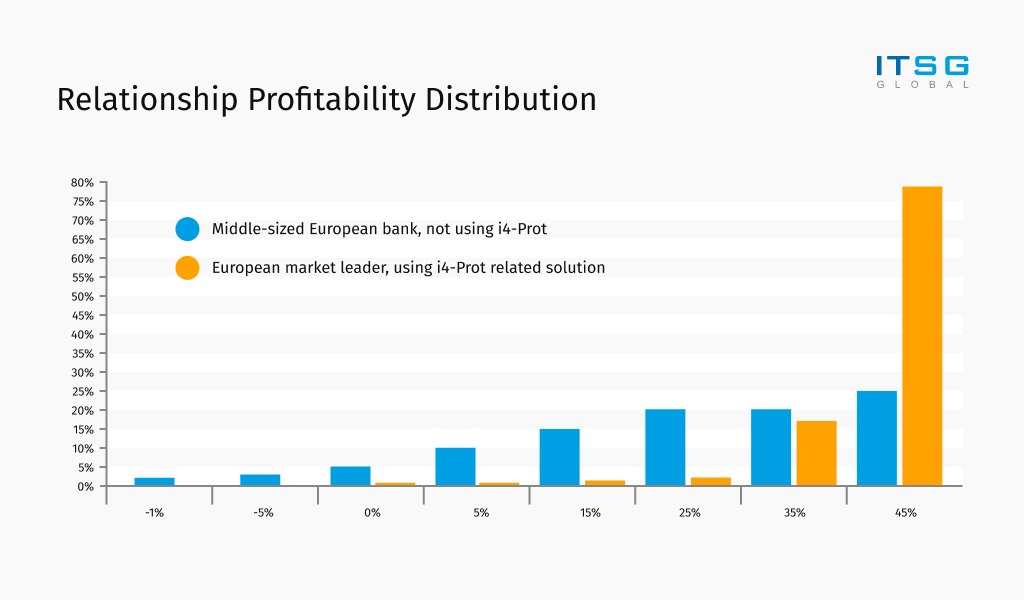

Overtaken by decreasing profitability on relationships and high pressure from competition, many banks are forced to promote more sales while losing value on their clients.

One European bank we studied faced decreasing profitability of existing relationships. Clients were negotiating terms of the engagement based on offers from other banks to get the best rates and prices. The bank’s sales team was unable to decide whether the deal they were offering was profitable for the bank or whether to turn the client away. In an effort to be competitive, they were signing deals that proved too risky and unprofitable. Their KPIs were set up to promote volume not value in terms of profits and ROE.

Through quick implementation and a user-friendly interface, i4-Profit provided solutions that enabled the organisation, at every level, to check the impact of every transaction on the company’s bottom line-answering the key question, is it positive or negative? This allowed the sales team to decide whether to accept the client’s terms, negotiate a new mix of terms and products or to turn them down entirely.

Currently over 70% of customer relationships at the bank are profitable and the bank is performing above average on the market.

TESTIMONIAL

Prior to using i4-Profit, the solutions we used were not ideal. They were based on MS Excel and therefore only met basic needs, i.e. very high-level assessment of the client’s profitability. i4-Profit is a much more advanced solution allowing us to not only keep business momentum but also support short term sales campaigns, track the Relationship Manager’s efficiency, maximize capital usage, and allow sales leaders, supervisors, and heads to have full control over the sale process.

Ex-ante profitability assessments allowed my organization to build portfolios of the companies with both good profitability as well as high quality. During years of the strongest SME business development we were able to set up new branches and break even in less than 8 months.

There is so much to say about i4-Profit – it is a game changer. This is the best tool I have ever seen to support sales and upper-management at the same time while reducing risk. Implementation was straightforward and we can make adjustments as market conditions change.

i4-Profit also changed the way our organisation thinks and works. Our sales people and relationship managers are capable of making educated decision on which products can be sold to which clients, making every transaction profitable for the bank. We are not only able to track whether the transaction is profitable once it occurred but we are able to predict with 99% accuracy whether it will be profitable before the contract is signed and adjust the deal terms accordingly.

We no longer just focus on selling current accounts, loans or deposits. Now we ensure our clients get what they want, but only if it brings profit for our company.

CEO, Medium-sized European Bank

BUSINESS OFFERING

Why i4-Profit:

- First ex-ante profitability controlling tool on the market

- Developed by team of experts from banking, IT and consulting

- Allowing for optimization of relations profit and/or equity used

- Providing non-biased information on real sales results

- Creating new class of software

- Highly customizable

- Complicated on the inside, simple on the outside

- Combining expertise from business, ALM, risk, product management and controlling

functions in one tool

- Able to support many different user classes from Sales Officer to CEO

- Available on PC / Mac / tablets

i4-Profit implementation options:

- Stand-alone – ready to use by end users in less than 30 days

- Integrated – working together with other core systems (core banking system, CRM, data

warehouse) through direct interfacing or integration layer

i4-Profit supported corporate/SME product types:

- Loans (working capital and investment products)

- Deposits

- Transactional products

- Derivatives

Retail offering supported by i4-Profit:

- Consumer loans

- Mortgage loans

- Deposits / Saving accounts

- Transactional products

i4-Profit modules:

- Profitability calculator

- Incentive calculator

- Basic reporting

- Advanced reporting

- Monitoring

i4-Profit flexible remuneration options:

- Depending on the bank needs we offer different price schemes. For more details please contact our Contact Center