Banking on the right AI deployment strategy

Quick Insights:

- Cloud deployment dominates GenAI in finance, with 54% of organizations increasing investments

- GenAI could add $200-340 billion in global banking value annually

- Hybrid and edge solutions are emerging for specific use cases like fraud detection and wealth management

The banking sector is rapidly integrating GenAI into its operations. Financial institutions must choose between cloud, edge, or hybrid architectures. This decision is not just technical but strategic, significantly impacting their competitive advantage.

Recap: Cloud, edge, and hybrid GenAI deployment

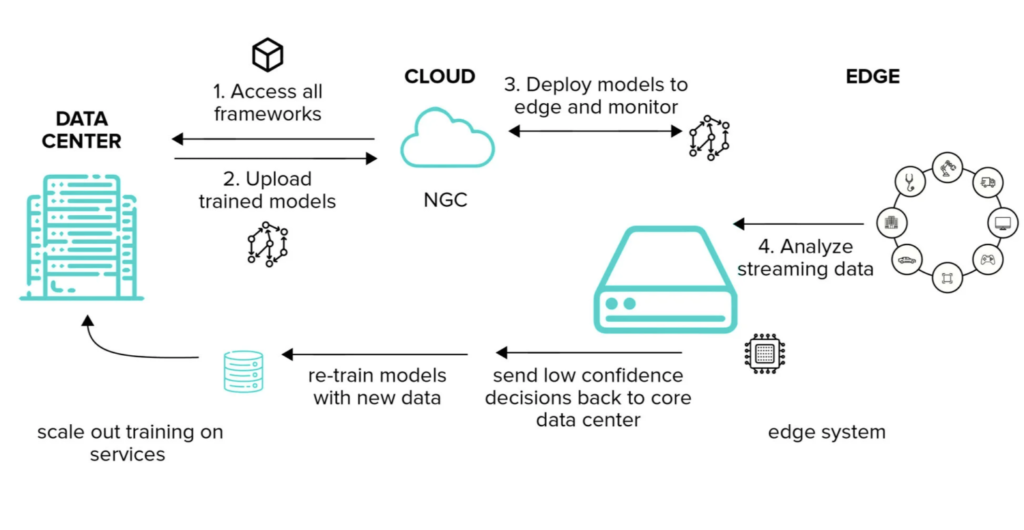

But before we go any further, let’s briefly recap the key deployment models:

- Cloud deployment runs GenAI models on remote servers, offering scalability and vast computational resources. It’s cost-effective but may introduce latency.

- Edge deployment (or local deployment) runs models on-premises or near data sources. It provides lower latency and enhanced security but may have scalability limitations.

- Hybrid deployment combines cloud and edge approaches, balancing performance, security, and cost based on specific use cases.

Each model has its trade-offs in performance, security, costs, and regulatory compliance. The choice depends on factors like application nature, data sensitivity, latency requirements, and scalability needs.

The banking sector’s adoption of these models reveals their strengths and limitations in real-world applications. Let’s look at a few examples.

Cloud Deployment: Scalability and Power

Cloud deployment is currently the dominant model for GenAI in banking and finance. According to a Wipro report, 54% of organizations are increasing cloud investments, partly due to the growing demand for generative AI services (1). This trend is not surprising, given the cloud’s unparalleled ability to scale and handle the massive computational requirements of GenAI models.

Enhanced Customer Service

In the realm of customer service, cloud-based GenAI is making significant strides. Wells Fargo’s virtual assistant “Fargo” stands as a testament to the power of cloud deployment. Since its launch in March 2023, this AI-driven solution has handled a staggering 20 million interactions and is on track to reach 100 million annually (3). This level of scalability would be challenging, if not impossible, to achieve with on-premises solutions alone.

But Wells Fargo’s foray into GenAI doesn’t stop there. Their Predictive Banking Feature is revolutionizing customer experiences through a blend of personalized insights and proactive financial advice. By simply tapping a blue light bulb icon in their mobile app, customers gain access to over 50 different AI-generated prompts tailored to their account activity (4, 5). This innovative approach not only offers practical budgeting tips and product recommendations but also aims to enhance financial literacy by translating complex financial data into easily digestible insights.

The benefits of cloud-based LLMs in customer service extend beyond these examples. They excel at:

- Deciphering context, sentiment, and nuance in customer queries

- Generating human-like responses to handle complex dialogues

- Delivering consistent, high-quality service across all interactions

- Providing multilingual support for global accessibility

These capabilities allow banks to offer personalized, round-the-clock customer support at a scale previously unimaginable.

Intelligent Process Automation

While customer-facing applications often steal the spotlight, the impact of cloud-based GenAI on back-office operations is equally transformative. Deutsche Bank, for instance, is leveraging cloud-based GenAI to tackle a trifecta of challenges: improving risk calculations, boosting developer productivity, and powering AI chatbots for both employee and customer queries (6).

This multifaceted approach highlights the versatility of cloud-deployed GenAI. By centralizing these diverse functions in the cloud, Deutsche Bank can:

- Rapidly scale its computational resources to meet fluctuating demands

- Ensure cost-efficiency compared to maintaining multiple on-premises systems

- Flexibly adjust its AI capabilities as new use cases emerge

- Accelerate the deployment and integration of new AI models across its operations

The cloud’s ability to handle these varied tasks simultaneously demonstrates why it’s become the go-to choice for many financial institutions looking to implement GenAI solutions.

Edge Deployment: Speed and Security

While cloud deployment dominates the GenAI landscape in banking, edge computing is carving out its own niche, particularly in use cases where split-second decisions and ironclad security are non-negotiable.

Automated Fraud Detection

Fraud detection serves as a prime example of where edge deployment shines. In this arena, Mastercard is leading the charge with its new fraud detection model. By leveraging edge computing capabilities, Mastercard expects to improve detection rates by an average of 20%, with some cases seeing staggering improvements of up to 300% (3).

These numbers aren’t just impressive on paper – they translate to real-world impact. In the high-stakes world of financial fraud, where every millisecond counts, edge deployment offers crucial advantages:

- Real-time transaction analysis and pattern matching right at the data source

- Ultra-low latencies for time-sensitive operations

- Enhanced security through on-premises processing of sensitive transaction data

But it’s not just about speed. IBM’s Z AI on-chip accelerator is pushing the boundaries of what’s possible with edge deployment in banking. This innovative solution enables real-time AI capabilities directly on the mainframe where data resides (7). This approach opens up new possibilities for tasks like automated credit decision-making and loan modification, where both speed and security are paramount.

Hybrid Approach: The Best of Both Worlds (?)

As the banking sector deals with the cloud-edge choice, many institutions are finding that the answer lies not in choosing one over the other, but in embracing both through hybrid approaches.

Personalized Marketing and Wealth Management

The world of wealth management and personalized marketing provides a compelling case study for the effectiveness of hybrid GenAI deployment. Here, the need for personalization clashes with the demand for scalability, creating a perfect storm that hybrid models are uniquely equipped to weather.

Morgan Stanley’s approach to this challenge is particularly instructive. The financial giant has deployed a GenAI chatbot to assist its army of 16,000 financial advisors, providing them with instant access to over 100,000 research documents (3). But they didn’t stop there. To fine-tune this AI assistant, Morgan Stanley formed a test group of 1,000 advisors to put the chatbot through its paces (8).

This hybrid approach allows banks like Morgan Stanley to:

- Securely process sensitive customer information locally

- Generate tailored insights and recommendations using cloud-based AI

- Maintain strict data protection standards while delivering personalized advice

Deutsche Bank is taking a similar tack in its wealth management services. Their AI system analyzes international private banking clients’ portfolios, determining if clients are overinvested in particular assets and matching customers with suitable investments. But here’s the crucial part: human advisers review these AI-generated recommendations before passing them to clients (9). This human-in-the-loop approach exemplifies how hybrid models can combine the best of both worlds – the computational power of AI with the nuanced judgment of human experts.

These examples illustrate how hybrid models are allowing financial institutions to navigate the complex terrain of personalized services in the age of AI. By strategically distributing tasks between local and cloud resources, banks can offer highly personalized services while maintaining the scalability needed to serve a large customer base.

The Road Ahead: Strategic Alignment is Key

As we’ve seen, there’s no one-size-fits-all solution for GenAI deployment in banking. The choice between cloud, edge, or hybrid models must align with an institution’s specific goals, regulatory requirements, and customer needs.

The stakes are high. McKinsey estimates that GenAI could add a staggering $200-340 billion in value to the global banking sector annually (2). Capturing this value will require careful consideration of deployment strategies:

- Cloud deployments offer unparalleled scalability, ideal for customer-facing applications and large-scale data processing.

- Edge solutions provide the ultra-low latency and enhanced security crucial for real-time applications like fraud detection.

- Hybrid models strike a balance, particularly valuable for wealth management and personalized services that require both security and scalability.

The banking sector is on the cusp of a major shift, with GenAI at its core. Financial institutions face a critical decision in how they deploy this technology. The perspective of hundreds of billion in annual value (2) emphasizes the importance of getting it right.

The key question for isn’t whether to adopt GenAI, but how to implement it effectively. Success will come from aligning deployment models—cloud, edge, or hybrid—with specific business needs and customer demands. The institutions that act decisively and thoughtfully with GenAI today will likely lead the industry tomorrow.

Sources:

- Wipro report (via marketresearch.biz): https://marketresearch.biz/report/generative-ai-in-finance-market/

- Neurons Lab: https://www.neurons-lab.com/article/the-future-of-finance-use-cases-for-generative-ai-in-banking/

- ITRex Group: https://itrexgroup.com/blog/generative-ai-in-banking/

- Netguru: https://www.netguru.com/blog/generative-ai-use-cases-finance

- Latinia: https://latinia.com/en/resources/artificial-intelligence-banking-comprehensive-outlook-2024

- GetDynamiq: https://www.getdynamiq.ai/post/generative-ai-and-llms-in-banking-examples-use-cases-limitations-and-solutions

- Luxoft: https://www.luxoft.com/blog/how-to-make-the-most-of-ai-and-ml-in-banking

- LitsLink: https://litslink.com/blog/artificial-intelligence-ai-in-wealth-management-a-practical-guide

- Wealth Management: https://www.wealthmanagement.com/technology/wall-street-banks-are-using-ai-rewire-world-finance